Tony Abbott’s missing ‘debt crisis’ and his other latest 15 lies

How duped were Australian voters? What kind of sheep were we? Will we wake up soon?

How duped were Australian voters? What kind of sheep were we? Will we wake up soon?

“Tony Abbott’s dishonest speech this week confirms fact-checking in federal politics remains a faraway fantasy, writes IA’s fact-checking guru Alan Austin. Tony Abbott is a self-confessed liar and here he is at it again. At a time when good faith would seem pretty important, the man who would be Australia’s leader spouts blatant lies with apparent impunity. This despite so-called fact-checkers at Channel Seven, The Conversation and coming soon to the ABC.

Mr Abbott’s address to the Australia-Israel Chamber of Commerce in Melbourne last Monday contained about twenty readily identifiable falsehoods — some are well-worn favourites from earlier speeches … plus fresh ones as well.

Here’s a top fifteen.

1. “The Howard/Costello Government … presided over what now seems like a golden age of prosperity – that’s been lost.â€

On most indicators, Australia is much wealthier now than 2007 — despite the worst economic downturn since the Great Depression. Indicators include income per person, pensions, superannuation, productivity and personal savings — all much higher now.

Plus interest rates, inflation and tax levels — all lower.

This is affirmed by international credit ratings, the value of the Aussie dollar and quality of life indices — all much better now.

2. “By contrast, the Rudd/Gillard Government has not just failed to continue this bipartisan legacy of [economic and workplace] reform; it’s reversed it.â€

Nonsense. Heritage Foundation’s economic freedom index reflects progress in freeing capitalists from government obstruction. Its latest survey ranks Australia first among Organisation for Economic Cooperation and Development (OECD) nations and third in the world. Australia’s current score is higher than the Coalition ever achieved.

3. “Each year’s deficit adds to Commonwealth debt, now rocketing past $300 billion with state debt on top.â€

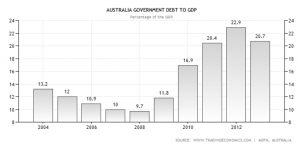

Untrue. Borrowings to build an economy are not the same as debilitating debt, as economist Stephen Koukoulas compellingly explains. Borrowings as a percentage of gross domestic product (GDP) are currently just 20.7%. Ten OECD countries are now above 90%, including the UK, the USA and France. Japan is above 210%.

Debt is not skyrocketing. It’s declining. Only ten wealthy nations reduced debt to GDP last year. Australia’s 2.2% reduction was only bettered by Iceland and Norway.

AustraliaDebt

The deficit is also falling. This year’s is less than half last year’s. At just 1.3% of GDP this is puny in comparative terms. Britain, Denmark, France, Israel and the Netherlands are above 4%. The USA, New Zealand and Japan are above 8.0%.

Further, the underlying budget deficit, according to the non-partisan Parliamentary Budget Office is partly due to blunders during the Howard years, including reducing petrol and tobacco excise receipts.

4. “GDP growth per head has been just one third of the Howard era.â€

This is a subtle porky, but a porky nonetheless. The essential dishonesty is denying the impact of the Global Financial Crisis (GFC) which devastated economies and reversed GDP growth worldwide.

The average annual increase in Australia’s gross domestic product was 3.65% during the 11 Howard years. Then down to 2.44% under Labor. So it is not down to one third, more like two thirds.

But here’s the deceit: Australia’s average growth through the Howard years was matched or bettered by several other economies. The USA averaged 3.04%. Canada 3.3%. Some European countries were higher. Luxembourg averaged 4.78%.

Then came the GFC. In Labor’s five years, growth has been 2.44%. But in the USA 0.54%, in Canada 0.94% and Luxembourg 0.52%. And the Euro Zone negative 2.3%!

AustraliaGDP

5. “Australia’s fundamental strengths owe far more to the reforms of previous governments than to the spending spree of the current one.â€

Evidence affirms the opposite. Most recently, a UNICEF paper by Bruno Martorano shows that while Europe’s austerity measures worsened their economies, Australia’s prompt spending “limited the possible negative effects caused by the macroeconomic shock and favoured the process of economic recovery.â€

6. “Australia’s debt position is better than that of some other countries – not because we’ve done better, but because we started better.â€

Not true. If it were, then other nations with no debt and strong budgets surpluses should have done well through the GFC. And nations deeply in debt and deficit would have done poorly. There is no such correlation.

Several countries which emerged from the GFC in good shape went in with huge debts at the outset. These include Israel, Switzerland and Singapore.

In contrast, Spain, Finland, Iceland and Chile all had modest debt and budget surpluses in 2008 yet suffered severe reversals.

7. “Sure, our economic position is stronger than that of the United Kingdom and much better than that of Greece and Italy and Spain, and France; but so was Ireland’s until quite recently.â€

Coalition spokespersons often suggest snidely that “Sure, Australia is doing better than Greece, Italy, Spain and Irelandâ€. Australia is in fact doing better than every economy. Economists debate whether Canada or Switzerland is second. But no-one challenges Australia’s position as world leader — and forging further ahead with each quarter’s results.

8. “It’s good that Mr Rudd … committed the Government to a new effort to boost productivity … but he’s never actually taken the steps needed to convert aspiration into achievement.â€

False. The data shows productivity increased dramatically for four quarters in 2009, despite the GFC. It stalled in 2010 as the global downturn hit businesses badly. Since 2010, productivity has increased for a record nine consecutive quarters to an all-time high.

9, 10, 11. “Tax reform starts with abolishing the carbon tax and the mining tax, which have done so much to spook investors, threaten jobs and hurt every family’s cost of living.â€

Three fibs in one sentence. Investment in Australia has not been impacted by the carbon tax. Total numbers of people employed have risen every quarter since the tax was introduced. And inflation is currently 2.4%. This is below the rate for most of the Labor period prior to the carbon tax, and below the rate for most of the last five Howard years.

12. “Based on previous experience, we are confident that these changes will produce a million new jobs within five years … unlike the anaemic job creation record of the past six years.â€

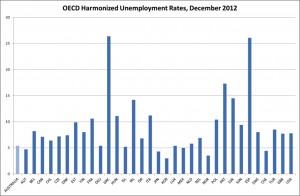

More than one million jobs have been created since 2007, a record unmatched in comparable nations. The UK, with a population and an economy three times Australia’s, managed 656,000 extra jobs in that period. The unemployment rate in Australia is 5.7%. In the UK it is 7.8%. In the Euro Area 12.2%.

The unemployment rates of 34 OECD economies as at December 2012. (Author: OECD; Image courtesy The Conversation)

13. “At the Press Club recently, Mr Rudd declared that the mining boom was over and that Australia needed to be ready for life afterwards.â€

False. Mr Rudd specifically affirmed that “the China resources boom is overâ€. There is a difference. Australia has other customers.

Rio Tinto reports that first half of 2013, iron ore production set a new first half record, driven by sustained productivity improvements and 2013 sales set a new record for a first half at two per cent higher than in 2012.

14. “What had obviously escaped him [Rudd] was Labor’s role in bringing the mining boom to a premature end with the mining tax … and a jungle of red and green tape that means a typical mine that took under 12 months to approve in 2007 can now take over three years.â€

This old favourite was debunked by Professor John Quiggin in early July.

15. “Also at the Press Club recently, Mr Rudd claimed credit for saving Australia from the global financial crisis — almost single-handedly apparently. Apparently he thinks that installing batts that caught fire in people’s roofs and building school halls for twice the normal price was good economic policy.â€

Multiple fibs here also. It is not Mr Rudd asserting that the stimulus packages saved Australia’s economy almost alone in the developed world from recession. Those claiming this include Joseph Stiglitz, Scott Haslem, Juan Jose Daboub, Dun and Bradstreet, John Quiggin, Rodney Tiffin, David Gruen, Glenn Stevens, Tim Harcourt and several business and union groups. Plus countless economics journalists.

As the CSIRO found, the rate of house fires and industrial injuries and deaths during 2009-10 fell to one quarter of the rate during the Howard years. Audits of the building programs found cost overruns to have been minimal.

There are other untruths in the speech. But there’s a start.

So how many are deliberate lies and how many reflect genuine misinformation? In other words, does the man suffer a major personality disorder or profound ignorance?

And where are Australia’s fact-checkers and what are they doing?”

article by Alan Austin

posted here under

Creative Commons Licence